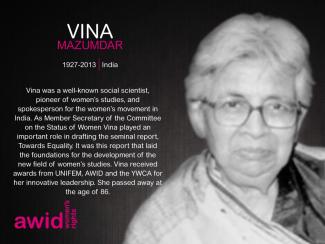

Vina Mazumdar

Feminist Realities are the living, breathing examples of the just world we are co-creating. They exist now, in the many ways we live, struggle and build our lives.

Feminist Realities go beyond resisting oppressive systems to show us what a world without domination, exploitation and supremacy look like.

These are the narratives we want to unearth, share and amplify throughout this Feminist Realities journey.

Create and amplify alternatives: We co-create art and creative expressions that center and celebrate the hope, optimism, healing and radical imagination that feminist realities inspire.

Build knowledge: We document, demonstrate & disseminate methodologies that will help identify the feminist realities in our diverse communities.

Advance feminist agendas: We expand and deepen our collective thinking and organizing to advance just solutions and systems that embody feminist values and visions.

Mobilize solidarity actions: We engage feminist, women’s rights and gender justice movements and allies in sharing, exchanging and jointly creating feminist realities, narratives and proposals at the 14th AWID International Forum.

As much as we emphasize the process leading up to, and beyond, the four-day Forum, the event itself is an important part of where the magic happens, thanks to the unique energy and opportunity that comes with bringing people together.

Build the power of Feminist Realities, by naming, celebrating, amplifying and contributing to build momentum around experiences and propositions that shine light on what is possible and feed our collective imaginations

Replenish wells of hope and energy as much needed fuel for rights and justice activism and resilience

Strengthen connectivity, reciprocity and solidarity across the diversity of feminist movements and with other rights and justice-oriented movements

Learn more about the Forum process

We are sorry to announce that the 14th AWID International Forum is cancelled

Given the current world situation, our Board of Directors has taken the difficult decision to cancel Forum scheduled in 2021 in Taipei.

Our 2010 Annual Report highlights the major accomplishments of each of our strategic initiatives during the year.

Along with activity highlights, we include a brief analysis of the impact of our initiatives as well as reflections from our members and partners that further illustrate the relevance of AWID’s work and its connection to broader women’s rights movements.

This interactive document is complete with links to our websites and recent publications with in-depth information on the issues we address in the report.

Margo Okazawa-Rey is an activist-educator and transnational feminist working on issues of militarism for nearly 30 years. She is a founder member of the International Women’s Network against Militarism and Women for Genuine Security, the US group of the Network. She has long-standing activist commitments with Du Re Bang/My Sisters Place in South Korea and Women’s Centre for Legal Aid and Counselling in Palestine. She also serves on the International Board of PeaceWomen Across the Globe in Bern, Switzerland and is President of the Board of Directors of Association for Women’s Rights in Development (AWID). Her foundational activist/life principle is that love is a radical act. She is also known as DJ MOR Love and Joy.

Eni Lestari is an Indonesian domestic worker in Hong Kong and a migrant rights activist. After escaping her abusive employer, she transformed herself from a victim into an organizer for domestic workers in particular, and migrant workers in general. In 2000, she founded the Association of Indonesian Migrant Workers (ATKI-Hong Kong) which later expanded to Macau, Taiwan, and Indonesia. She was the coordinator and the one of the spokesperson of the Asia Migrants Coordinating Body (AMCB) - an alliance of grassroots migrants organisations in Hong Kong coming from Indonesia, Philippines, Thailand, Nepal and Sri Lanka. She is also the current chairperson of International Migrants Alliance, the first-ever global alliance of grassroots migrants, immigrants, refugees, and other displaced people.

She has held important positions in various organizations including and current Regional Council member of Asia Pacific Forum on Women, Law and Development (APWLD), former Board Member of Global Alliance Against Traffic in Women (GAATW), spokesperson for Network of Indonesian Migrant Workers (JBMI), advisor for ATKI-Hong Kong and Macau as well as the Association of Returned Migrants and Families in Indonesia (KABAR BUMI). She has been an active resource person in forums organized by academics, interfaith groups, civil societies, trade unions and many others at national, regional, and international arenas.

She has actively participated in United Nations assemblies/conferences on development and migrants’ rights and was chosen as a speaker at the opening of the UN General Assembly on Large Movement of Migrants and Refugees in 2016 in New York City, USA. She received nominations and awards such as Inspirational Women by BBC 100 Women, Public Hero Award by RCTI, Indonesian Club Award, and Non-Profit Leader of Women of Influence by American Chamber Hong Kong, and Changemaker of Cathay Pacific.

Rachel is a financial professional with over two decades of experience. She has overseen financial affairs and projects for private and public entities, non-profits, and international non-governmental organizations. A Chartered Accountant with a Global Master’s in Business Administration, she is also a member of the South African Institute of Chartered Accountants. In her spare time, Rachel designs typography art, enjoys traveling and spending time with family and friends over a bottle of wine.

For decades, feminist scholars and advocates have articulated important concepts related to gender to understand and challenge oppression and discrimination. Those concepts have now become the target of anti-rights actors who claim that oppressive patriarchal gender roles are “common sense”, strategically painting all other ideas, cultural norms, and forms of social life as a dangerous, conspirative ideology.

Read our Brief on “Gender Ideology” Narratives: A Threat To Human Rights

The AWID international Forum is a gathering of 2,000 women’s rights leaders and activists from around the world. The AWID Forum is the largest recurring event of its kind, and every Forum takes place in a different country in the global South.

The AWID International Forum is both a global community event and a space of radical personal transformation. A one-of-a-kind convening, the Forum brings together feminist, women’s rights, gender justice, LBTQI+ and allied movements, in all our diversity and humanity, to connect, heal and thrive.

When people come together on a global scale, as individuals and movements, we generate a sweeping force.

Join us in Bangkok, Thailand and online in December 2024.

Asociación de Mujeres Afrodescendientes del Norte del Cauca

Release of the Zero-Draft Outcome Document, March 2015

Women sustain Care | Care Sustains Life | Life Sustains Economy | Who takes care of women? | Not one less1 | Together | Sunday lunch

1Nenhuna a menos literally translates as “not one woman less” or “ni una menos” in Spanish - a famous feminist slogan in Latin America that emerged in Argentina as a response to increasing gender-based violence.

The AWID Forum registration fees for all forum participants cover:

This is Mariama Sonko, an inspiring small-scale rural farmer, eco-feminist and a woman human rights defender.

She lives in Niaguiss, a town in the southwest of Senegal. Growing up in a family and community of rural farmers, she witnessed the essential role of women in food production and seed preservation from a very early age, while also being immersed in the rhythms and working of the land. Mariama has been defending local agricultural knowledge and peasant practices since the 1990s. As a mother of five children, the food she grows herself is the main source of sustenance for her family.

She is currently the president of “Nous Sommes la Solution'' and is involved in promoting agroecological practices and family farming, encouraging food sovereignty, biodiversity and farmer seed preservation, and demanding equitable access to resources and land for women across West Africa.

Source: AWID’s Feminist Realities Festival Crear | Résister | Transform - Day 2/ 2ème jour/ 2º día